Cut Through the Noise First

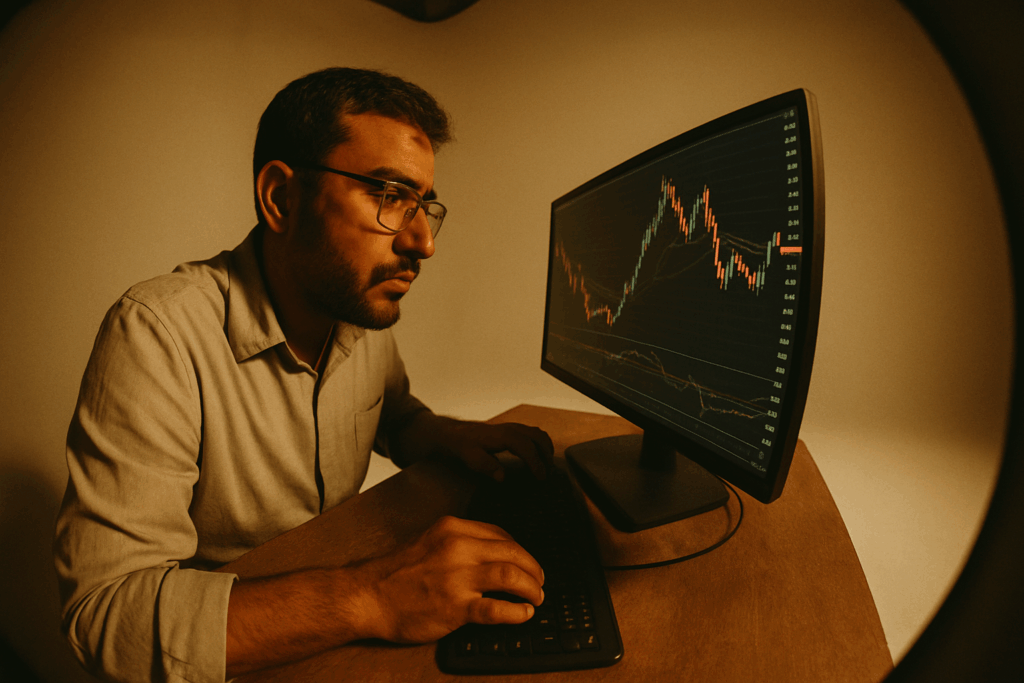

Stock news comes fast, loud, and often wrapped in drama. Headlines scream “market crash” or “stock surges,” but the reality behind the clickbait is usually less extreme. As an investor, your job is to filter the noise.

Start by separating headlines from actual facts. A company missing earnings by a cent sounds disastrous in the title but dig into the numbers and it might still show long term growth. Emotion laced reporting grabs attention, not clarity. If the language is packed with words like “panic,” “soars,” or “bloodbath,” take a step back. Check the data before reacting.

Instead of chasing the drama, focus on the fundamentals. Revenue trends, guidance, macro conditions these matter more than hot takes. Investing based on emotional stories rarely ends well. Let the numbers set the tone, not the headline.

Break Down the News by Category

Not all headlines are created equal. Knowing what kind of news you’re looking at helps separate signal from noise. Here’s how to break it down:

Earnings reports: Focus on year over year comparisons, revenue growth, and profit margins. Ignore the fluff like whether a company beat analyst estimates by a penny. One time charges or accounting quirks often skew the surface level numbers. Look for forward guidance, changes in customer demand, and shifts in cost structure. That’s where the real story lives.

Macroeconomic indicators: Pay attention to inflation, interest rates, and jobs data. These influence the broader market. Higher interest rates typically cool growth stocks. Rising inflation can ding consumer spending, while strong employment numbers can signal economic resilience. Context matters don’t just react to the headline figure; dig into what’s driving it.

Sector specific news: Tech layoffs hit different than oil price hikes. Tailor your attention. A wave of tech job cuts might mean tighter startup funding or pivoting business models. Surging energy prices affect transportation, manufacturing, even consumer behavior. If you have exposure in a sector, read those headlines closely.

Geopolitical events: War, trade policy shifts, or regulatory crackdowns can move markets instantly and heavily. But watch for overreactions. A military flareup overseas might hammer stocks short term but fade quickly. On the other hand, long term repositioning of global supply chains or sanctions can reshape entire industries.

Context turns news into insight. The market reacts instantly, but smart investors move with purpose not panic.

Look for Patterns Over Reactions

One bad quarter doesn’t mean the ship is sinking. Companies stumble. Sectors slow down. Markets overreact. The smart investor doesn’t flinch. Instead, they zoom out.

Use moving averages 30 day, 90 day, even year over year to see the real trajectory. Are earnings dipping once, or trending down over time? Is the sentiment online panic fueled, or is there real pressure building? Tools that track investor sentiment, as well as company fundamentals, can help split signal from noise.

And when headlines scream sell, sometimes the best move is to do absolutely nothing. Algorithms and media tend to amplify short term pain. But investing is a long game. You build advantages not by chasing spikes, but by watching the slope. Reacting to every blip isn’t strategy it’s stress.

Check the Source

Not all news is created equal. When you’re making investment decisions, start by going as close to the source as possible. Prioritize original reporting, earnings call transcripts, SEC filings, and notes from reputable analysts. These are the raw ingredients everything else is someone else’s recipe.

It’s tempting to skim headlines on social media and form an opinion in five seconds. Don’t. Social platforms are built to amplify noise, not insight. Too much of the commentary is speculative, misinformed, or worse actively pushing an agenda.

Pay attention to who’s writing the story. Is it an informed journalist, or a Twitter thread chasing clout? Ask yourself: Who benefits from this narrative? Smart investors always check for conflicts of interest and stay wary of hype disguised as analysis. Trust, but verify and mostly just verify.

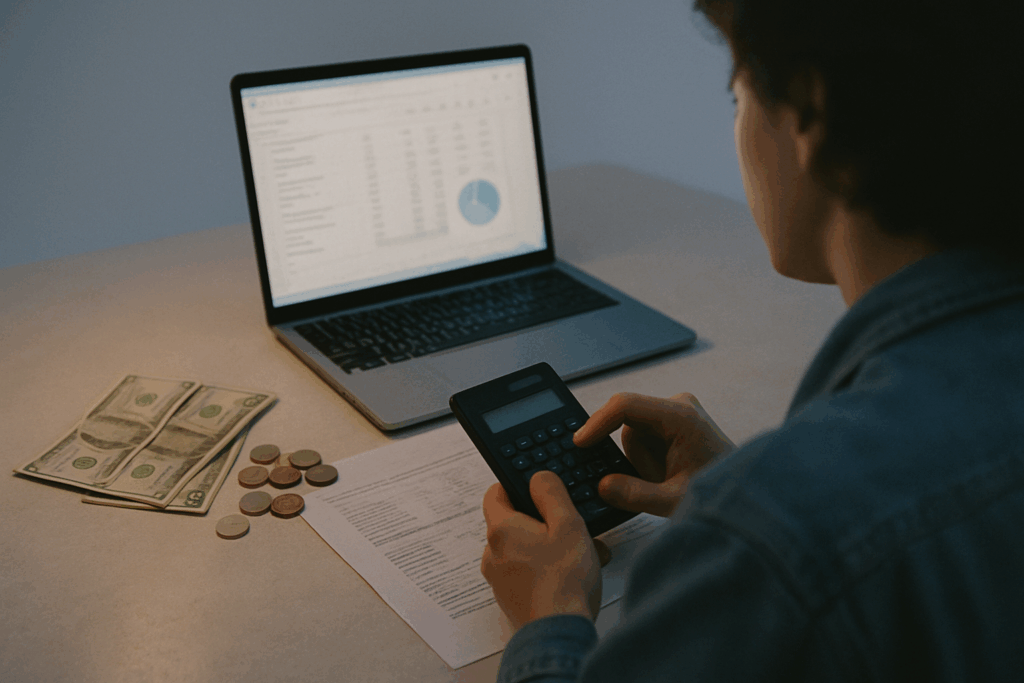

Connect News to Your Portfolio

Before you react to any market headline, stop and ask the obvious: does this actually impact what you own? Not every piece of news deserves your attention, let alone your action. A supply chain disruption in Asia might hammer tech hardware stocks, but if your portfolio is all domestic banks and utilities, it’s noise not signal.

Go a level deeper. Break down your holdings by sector and region. If inflation data spikes in Europe, but you’re all in on U.S. small caps, your risk profile might be unchanged. On the other hand, if you’ve got ETFs tied to global consumer trends or multinational firms, you might need to zoom in.

Let the news inform your strategy, not hijack it. Good investors don’t flinch with every headline. They adapt their thinking, not their entire portfolio. News can be a tool but it’s not in charge. You are.

Track Currency and Macro Signals Too

Why Currency Trends Matter

Currencies can offer early clues about broader market sentiment. Significant shifts in currency value often reflect mounting investor concerns or optimism about a nation’s economic health. Watching how the U.S. dollar, euro, yen, or emerging market currencies perform can give you context beyond the stock ticker.

Rising U.S. dollar: May signal global risk aversion

Weakening currency: Could indicate inflation or political instability

Sudden FX movement: Often a preview to sector volatility (like exports or commodities)

FX Volatility and Your Stocks

Even if you’re not directly trading foreign exchange (FX), currency swings can ripple into your portfolio:

Foreign operations: Companies with global exposure may see earnings affected by exchange rates.

Commodities: Oil, metals, and agriculture prices are often currency sensitive.

Emerging markets: These stocks are especially vulnerable to FX instability, particularly when tied to debt in foreign currency.

Understanding how interconnected currency signals are with other macroeconomic forces gives you a more complete map of risk.

Keep Learning and Reading

For a deeper dive into current currency shifts and what they could mean for markets, explore this resource:

Currencies aren’t just a footnote they’re a signal. Read them with care, and they can inform sharper, more global investing decisions.

Final Filters Before You Act

Before you make any move, slow down. News spreads fast, but that doesn’t mean it’s accurate or useful. Cross check the story across a few reputable sources. If it’s only showing up on one sketchy blog or social feed, it’s not actionable. Real insight stands up to scrutiny.

Next, pull up real time data. Look at how the market’s reacting volume spikes, price movement, volatility. If a stock is surging or plummeting but there’s no volume behind it, something smells off. Watch for confirmations: upgraded guidance, SEC filings, maybe a comment from company leadership.

Finally, run it past your own plan. Does this news actually relate to anything you own or want to own? Jumping on headlines that don’t align with your long term goals is how portfolios go sideways. Keep your strategy front and center. The news is just one filter not the deciding factor.

Pro Tip: Stay Curious, Stay Skeptical

Even the most experienced investors can get caught up in sensational news cycles. But thoughtful investing requires a disciplined, analytical mindset especially when headlines are designed to provoke emotional reactions rather than inform.

Treat News as Input Not Instruction

News should support your decision making, not control it. Before reacting, pause and ask yourself:

What’s the source of this news?

Is it reporting facts, or interpreting them?

Does this change the fundamentals of a company or sector I’m invested in?

If the answer isn’t clear, step back. It’s better to wait for clarity than to make decisions based on unverified or incomplete information.

Read Widely, Act Selectively

Strong investors cast a wide net for quality information but they process it through a selective filter. Consider:

Following credible financial outlets instead of relying on hype driven influencers

Prioritizing long term relevance over short term buzz

Using multiple perspectives to challenge your own assumptions

Ask the Right Questions Before You React

Not everything that’s interesting is actionable. Before making changes to your portfolio based on news, ask:

Does this affect my investment timeline or goals?

Is the news already priced into the market?

Am I reacting emotionally or strategically?

Bottom line: Read actively. Question consistently. React rarely. That balance is what separates personal investors who grow their wealth from those who simply chase the noise.